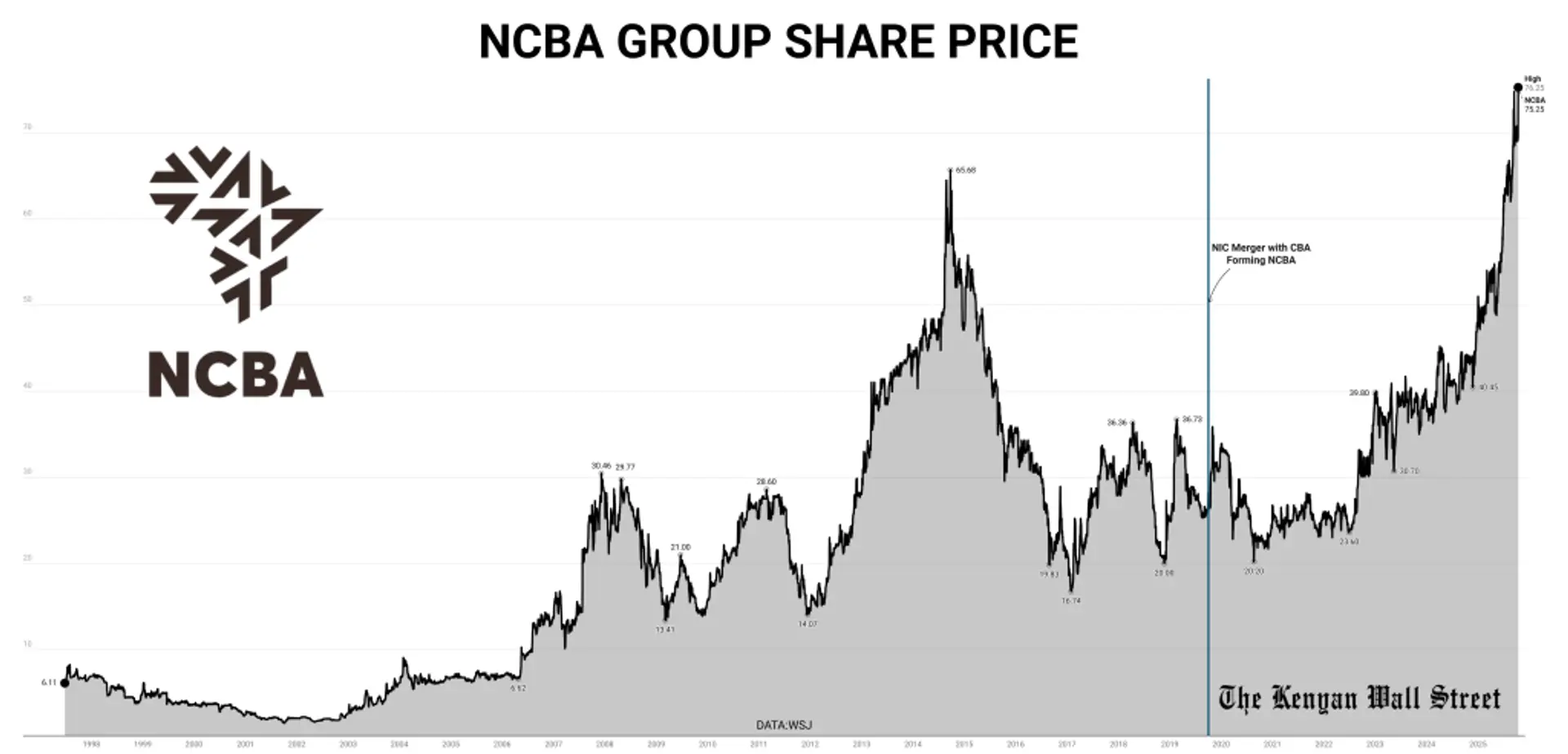

NCBA Group Plc shares rallied to a record high after Bloomberg reported that Standard Bank Group’s Kenyan unit, Stanbic Holdings Plc, is in talks to acquire the lender.

- •The stock jumped 8.27% to KSh 75.25 on the Nairobi Securities Exchange (NSE), valuing NCBA at KSh 124 billion, its highest level since the 2019 merger between NIC Bank and CBA Group that formed the current entity.

- •The surge lifted NCBA to Kenya’s third-most-valuable bank and fifth-largest listed company, behind Safaricom, Equity Group, KCB Group and East African Breweries.

- •The Bloomberg report, citing people familiar with the matter, said the transaction would create Kenya’s third-largest lender with assets of about KSh 1.1 trillion.

The lender’s consistent profitability, stable dividend record, and expanding digital portfolio have reinforced investor confidence ahead of any official confirmation from Stanbic or the Central Bank of Kenya.

For real time market updates and analysis, join our WhatsApp Channel.

The speculation triggered heavy trading, with 341,475 shares worth KSh 25.7 million changing hands. The stock has gained 7.5% in one week, 40.7% in six months, and 71% over the past year, outperforming the wider market and banking peers.

Analysts said investors are betting on both the potential merger premium and NCBA’s improving fundamentals.

Financial Strength and Growth Path

NCBA’s half-year 2025 results underline its sustained growth. Profit after tax rose 12.6% to KSh 11.1 billion, driven by a 26.7% rise in net interest income to KSh 20.9 billion.

Operating income increased 12.7% to KSh 35.3 billion, while total assets stood at KSh 663 billion and shareholders’ equity climbed 16.8% to KSh 118 billion. Gross non-performing loans fell 18.6% to KSh 38.1 billion, reflecting stronger credit quality.

CEO John Gachora commenting on the interim results said the group remains optimistic amid stable macroeconomic conditions, citing low inflation, a firm shilling, and sustained credit demand. With robust profitability, strong capital levels, and renewed merger speculation, NCBA has become the Nairobi bourse’s standout banking stock of 2025.

.png?key=small-avif)