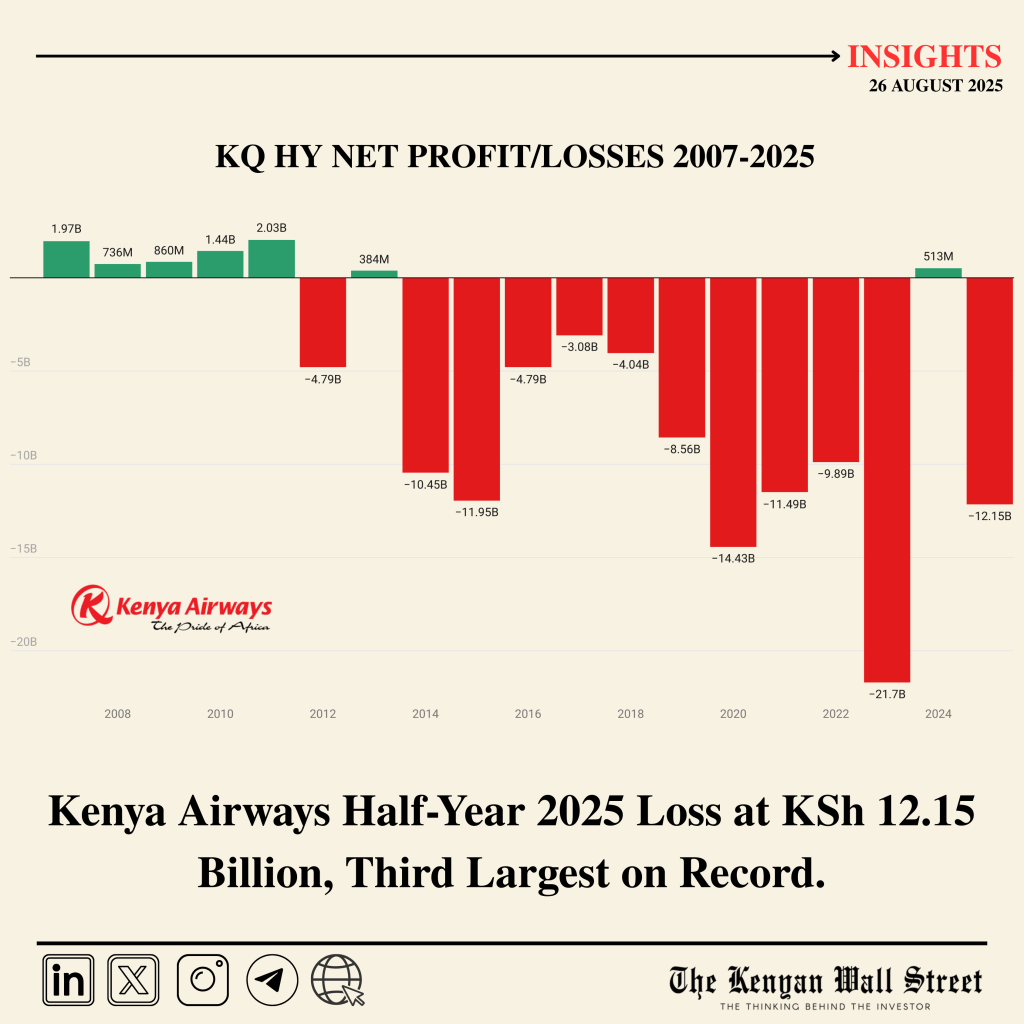

Kenya Airways swung to a KSh 12.15 billion half-year net loss for the period ended June 30, 2025, from a KSh 513 million profit a year earlier.

- •Grounded Boeing 787-8 Dreamliners, supply chain constraints, and reduced capacity weighed heavily on performance.

- •Revenue fell sharply, while cost pressures and forex impacts eroded margins, underscoring the airline’s fragile recovery.

- •The KSh 12.15 billion deficit is the airline’s second-biggest half-year loss in the past five years and third-largest in the last 13 years.

Total revenue declined 19% to KSh74.5 billion from KSh91.5 billion a year earlier, reflecting a 14% drop in passenger numbers and a 16% reduction in available seat kilometres. Operating losses stood at KSh6.2 billion, reversing an operating profit of KSh1.3 billion a year earlier.

| Metric | Jun 30, 2025 | Jun 30, 2024 | YoY % |

|---|---|---|---|

| Total Income | 74.50 Bn | 91.49 Bn | -18.6% |

| Total Operating Costs | 80.74 Bn | 90.20 Bn | -10.5% |

| Operating (Loss)/Profit | -6.24 Bn | 1.30 Bn | Worsened |

| Operating Margin % | -8.4% | 1.4% | Worsened |

| Other Costs | -5.97 Bn | -0.69 Bn | Worsened |

| Interest Income | 35 Mn | 23 Mn | +52.2% |

| (Loss)/Profit Before Tax | -12.17 Bn | 634 Mn | Worsened |

| Taxation | 19 Mn | -121 Mn | Improved |

| Net (Loss)/Profit After Tax | -12.15 Bn | 513 Mn | Worsened |

| Net Margin % | -16.3% | 0.6% | Worsened |

| Total Assets | 180.39 Bn | 179.10 Bn | +0.7% |

| Total Equity | -129.57 Bn | -118.25 Bn | Worsened |

| Total Liabilities | 309.95 Bn | 297.36 Bn | +4.2% |

Headwinds

The airline cited limited engine availability, global spare parts shortages, and capacity constraints as major headwinds.

- •Fleet ownership costs rose 29% following remeasurement of leased assets and an additional aircraft, while overheads increased by 64% due to currency stability compared to the prior period when forex gains boosted earnings.

- •Operating costs, however, eased by 10% due to reduced flying activity.

Encouragingly, one of the grounded Dreamliners resumed operations in July 2025, with the remaining two expected back later in the year. Management said new routes, expanded destinations, and supplier agreements for critical parts would support recovery.

Group CEO Allan Kilavuka said the recapitalisation plan, targeting at least US$500 million, will be key to stabilising liquidity, funding fleet expansion, and diversifying revenue streams. “Our focus remains on restoring aircraft availability, containing costs, and pursuing strategic investment to strengthen our financial footing and support long-term growth,” he noted.

Trend Analysis (2007–2025)

Kenya Airways’ results highlight a longer trend of persistent losses. The airline has reported losses in 13 of the last 14 half-year periods. Only six half-years since 2007 recorded profits, with the last major streak between 2007 and 2011. HY2023 marked the biggest half-year loss at KSh 21.7 billion, while HY2025’s KSh 12.15 billion is the second-largest in the past five years and third-biggest in the last 13 years. Even when profitable, margins have been thin, such as KSh 0.38 billion in 2013 and KSh 0.51 billion in 2024.

The broader aviation sector continued to face challenges including spare parts delays, geopolitical risks, and regulatory costs, though demand for air travel across Africa remained resilient. Kenya Airways expects its recovery to be gradual, contingent on fleet restoration, recapitalisation, and stable macroeconomic conditions.

.png?key=small-avif)